Helping hardworking Kiwis and businesses make confident choices.

Lending and insurance solutions for Kiwi first home buyers, property investors & developers, and businesses.

Our services.

Home loans.

The ever-changing property market calls for a mortgage expert who understands your goals and the industry. Our Auckland Mortgage Brokers provide tailored guidance on interest rates, cash-backs, and strategies, offering solutions to suit diverse needs and budgets.

Personal insurance

Whether it be affordable premiums, quality cover OR pre-existing conditions, we can help! Strategic, personalised life, health, income protection insurance solutions for different needs and budget. We are your claims advocate, and we conduct regular reviews so that your cover reflects your changing needs.

Construction loans

Vive Capital is our lending wing that provides tailored commercial lending solutions for property developers, through savvy guidance to maximise opportunities and drive growth.

Commercial loans.

Whether it's business acquisition loans, asset finance or protecting your most valued assets, your people in the business - we have tailored solutions that fit different budgets and needs.

The Vive Process.

1. Initial Consult (FREE) →

We have an initial 15 minutes, non-obligatory chat.

2. Information Gathering →

We gather information about your situation to determine how you're placed and what solutions to provide you with.

3. Strategy Session& Implementation →

We present you with a few solutions that fit your needs and cashflow. We then help implement the solution you choose.

4. Reviews & Advocate for Life.

We become your financial advocate for life, growing with you. We also check-in regularly to re-assess your needs and goals to ensure the lending and/or insurance solution we implemented, are fit-for-purpose.

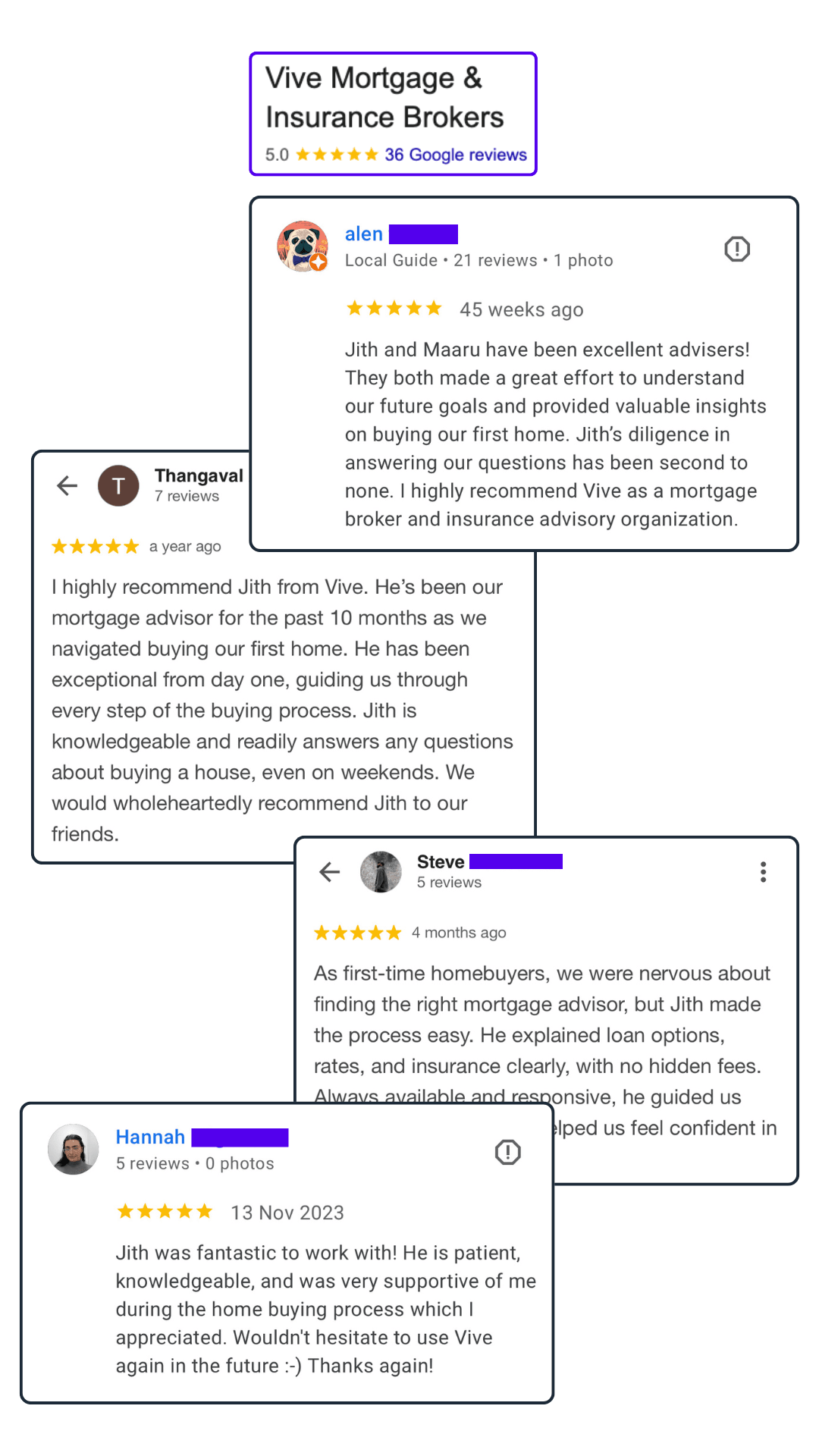

Who we are.

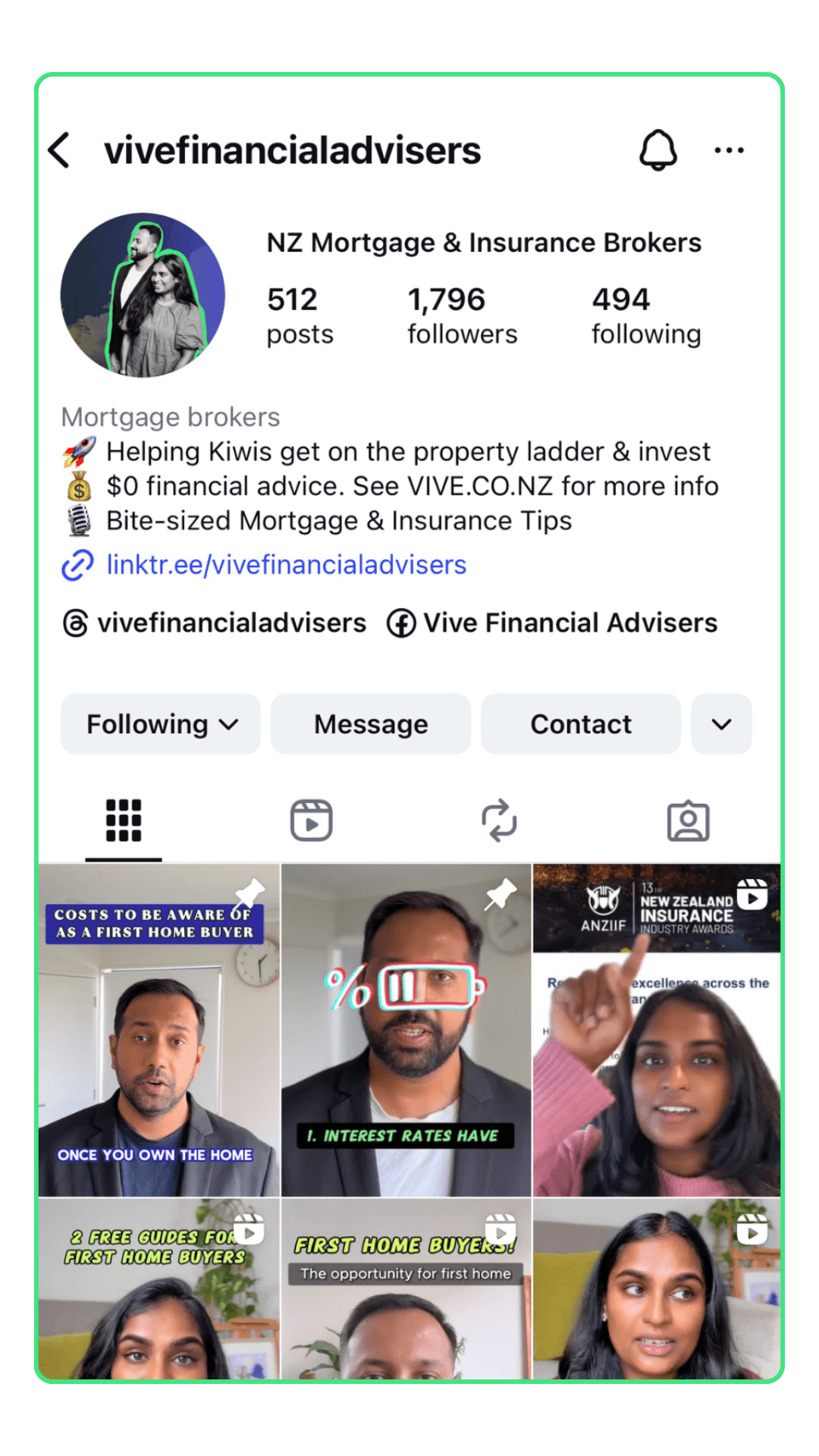

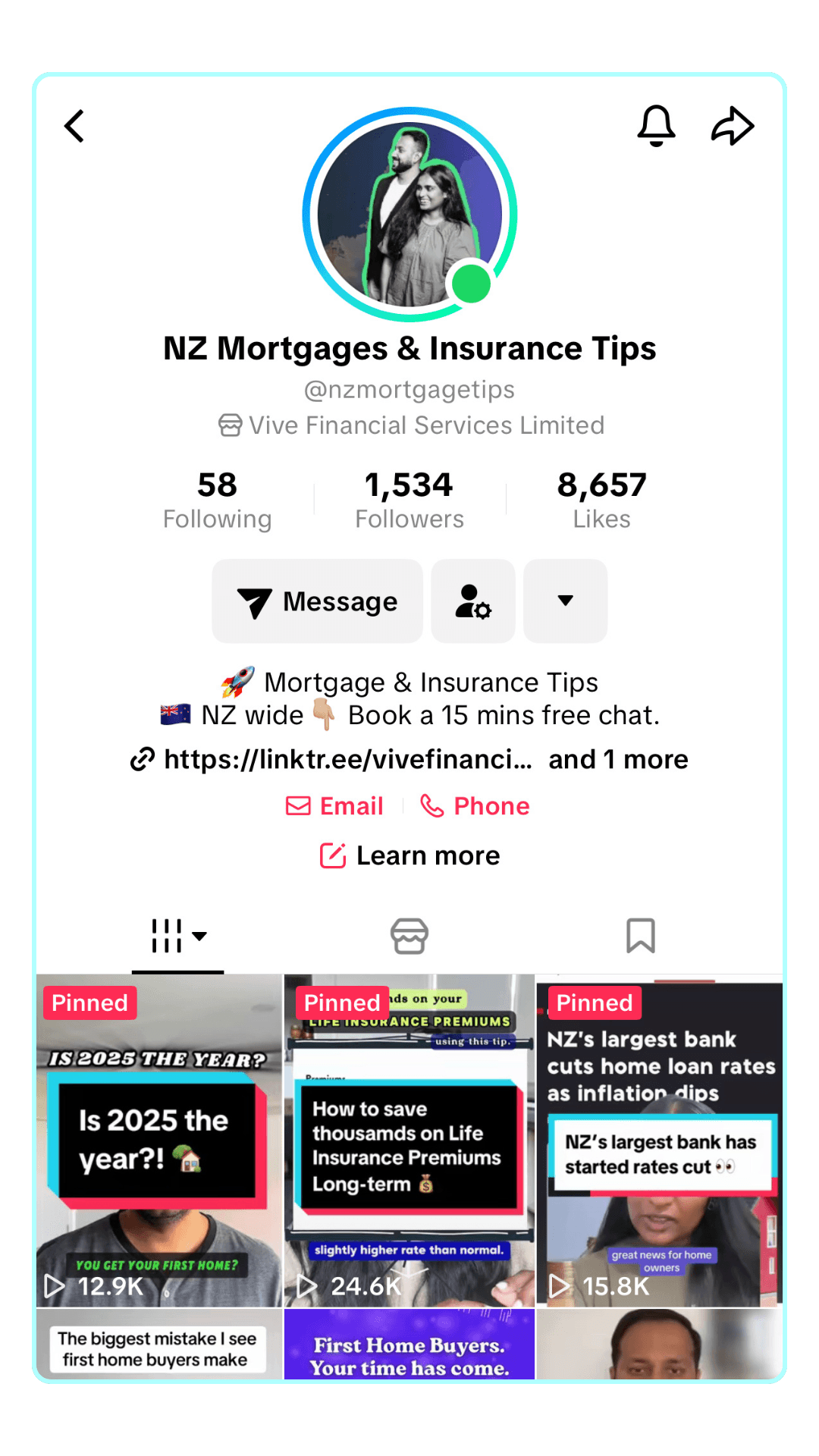

We are a financial advisory firm based in Auckland and service clients New Zealand-wide. Our talented Auckland Mortgage and Insurance Brokers focus on providing strategic mortgage and insurance advice, for young professionals and growing families. We are commonly known as Mortgage Brokers and Insurance Brokers.

FREE Advice? How? Why?

At Vive, our advice is free of charge to you.

Why? How? Because when you choose to proceed with a loan or insurance policy that meets your needs, we’re paid a commission by the lender or insurer—this compensates us for the time and resources involved in researching your options and implementing your solution.

Fees may apply in the following situations:

Early Cancellation: If your loan or insurance policy is cancelled within 24 months of inception, a fee may apply to recover advice-related costs. This will be minimum 3 hours (for meetings, researching options, application to lender / insurer, preparing record of advice + recommendations, etc), charged at $250 per hour, capped at 10 hours. No fees are chargeable for loan contracts or insurance policies cancelled outside the first 24 months period.

No Commission Products: If your chosen product doesn’t pay a commission, we may charge a fee of $250 per hour (GST inclusive), with a minimum charge of 3 hours, capped at ten hours.

Any applicable fees beyond the minimum three hours of billable time, will be disclosed before starting advice and/or at the time we provide advice.

For clients who experience difficulty with payments, we have a few affordability options to assist. We will always communicate with reasonable steps before generating an invoice.