Intro to swap rates

An interest rate swap is essentially an agreement between two parties (usually banks, financial institutions, corporations and investors) who swap their cash flows.

For example -> Party A has fixed-rate debt liabilities but wants floating rate obligations, and Party B has floating rate debt liabilities but but wants fixed rate obligations.

In this example, Party B is called the ‘fixed rate payer’ and Party A is the ‘floating rate payer’.

In New Zealand, the floating rate used is the 90-day bill rate and the fixed rate is the ‘swap rate’.

Therefore, Party B pays the swap rate semi-annually throughout the contract term. Since this is a fixed rate, the payments stay the same regardless of whether swap rates increase or decrease over time.

Party A receives the fixed swap rate from Party B and pays the 90-day bill rate quarterly. Since this is a floating rate, the payment is based on the 90-day bill at the time of payment. If 90-day rate goes up, so does the repayments for Party A and vice versa.

To summarise the above:

Swap rates represent the fixed interest rates that financial institutions agree to pay or receive in exchange for a floating interest rate over a specified period.

It helped financial institutions manage their floating rate debt by allowing them to agree with another financial institution to pay fixed rates and receive floating rate payments (and vice versa).

Swap rates are used to:

Manage interest rate risks i.e. the value of financial instruments such as bonds, will change as interest rates change.

Hedge against interest rates by locking in a fixed rate over a period of time.

What do swap rates represent?

The swap rate reflects market expectations of future interest rates. When swap rates rise, it generally indicates an expectation of higher future interest rates, and conversely, when swap rates decrease, it suggests an expectation of lower future interest rates.

For example, at the time of writing this article, the one-year swap rate is 5.45%. This means that market has priced an average of 5.45% for the wholesale rate over the next one year.

What influences swap rates?

Swap rates are determined in the financial markets and are influenced by various factors such as economic conditions, inflation expectations, RBNZ (central bank) policies such as OCR, and global market trends.

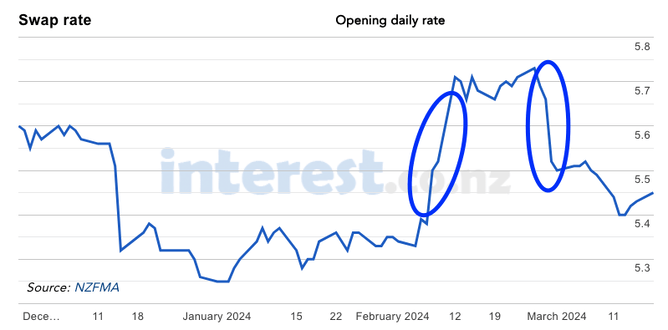

Swap rates are volatile and sensitive. Two examples of this is February 2024 (see image below):

When ANZ made a bold statement in early February (that got all the headlines) that OCR will go as high as 6% - The swap rates spiked even though it was just their prediction.

The swap rates stayed high until the OCR announcement at the end of February 2024. The swap rates dropped after the announcement because the RBNZ sounded more ‘dovish’. Had they had a ‘hawkish’ outlook, the swap rates may not have dropped and could possible have increased.

The above shows how sensitive swap rates can be. All it takes is a headline prediction or the tone of an announcement.

How do swap rates affect mortgage interest rates?

Swap rates play a significant role in determining mortgage interest rates in New Zealand, particularly for borrowers opting for fixed-rate mortgages.

Lenders often use swap rates as a reference point for setting the fixed interest rates on mortgage loans.

For borrowers opting for fixed-rate mortgages, changes in swap rates can directly influence the interest rates offered by lenders. If swap rates rise, lenders may increase the fixed interest rates on new mortgage loans to maintain profitability and manage risk.

Lenders may adjust their mortgage rates in response to changes in swap rates to remain competitive in the market. If one lender lowers their fixed mortgage rates based on a decrease in swap rates, others may follow suit to attract borrowers.

On the other hand, movements in OCR tend to have an effect on floating mortgage rates.

Overall, swap rates are closely watched by housing market commentators as a predictor of mortgage lending rates.

It's important for borrowers to stay informed about market trends and factors influencing swap rates to make informed decisions about their mortgage options.

Disclaimer

The information contained in this article is general information and is not intended to be financial, legal or tax advice. Vive Financial Services Limited and Jith Rajenthiram accept no liability for any loss caused as a result of any person relying on any information in this guide. Before making any financial decisions, you should consult a mortgage adviser or an appropriate professional.