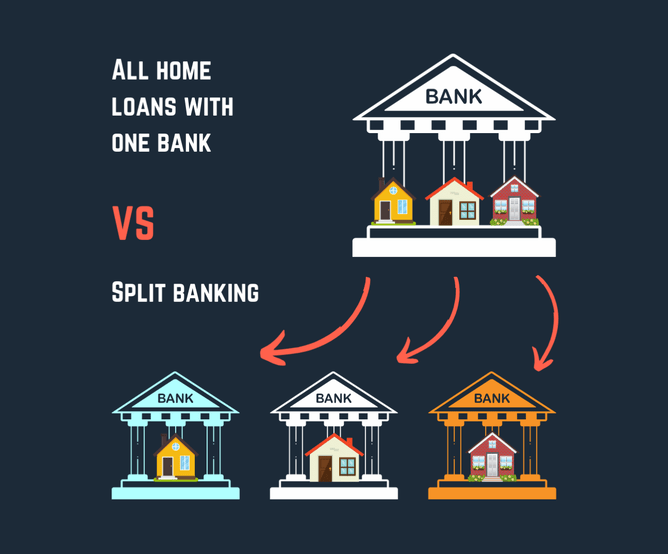

If you have multiple properties with the same bank - you should consider 'Split Banking'.

Split banking basically means that you spread your property porfolio across multiple banks.

There are three major reasons for why you should consider split banking:

Peace of Mind

If unforseeable circumstances arise and you are unable to pay the mortgage on one of your properties, the bank has the option to dip into your other properites to pay down debt (including the home you live in).

Having your properties with mulitple banks can avoid this trap and give you peace of mind.

Protection over Sales Proceeds

If you sell one of your properties, the banks will assess whether you have enough equity in your other properties and whether you have enough income to service the remaining debts.

If the bank is not satisfied - they will take your sales proceeds to pay down the debts on your other properties. This catches alot of people offguard!

Releasing Equity

If you have all your properties under one bank - your debt-to-equity mix could be very inefficient if you are looking to expand (especially if you have bought a newbuild recently).

Strategically spitting your properties can free up equity that can enable you to purchase your next property sooner than you thought.

Feel free to reach out if you require help restructuring your property portfolio via split banking.

Disclaimer

The contents of this article is for information-only and may express the opinion of the writer. This article is not be taken as personalised financial advice, as everyone’s situation is different. Please always seek advice from a financial adviser before making any decisions with your personal and/or business finances.