A one-stop first home navigator for kiwi first home buyers.

Welcome to Stride - Vive's strategy and coaching service for first home buyers.

Buying your first home is one of the most exciting and overwhelming journey. NZ First Home Navigator is here to guide you through it.

From pre-approvals, to financial fitness checks, to the right people you'd want on your team, WE'VE GOT YOU.

Just imagine having the ability to see:

Whether you're likely to have the quality of life and choices, you want in, 10, 20, 30 years' time?

How far you’re from your first home or your next property?

How you can pay down mortgage fast?

When you can afford your next family holiday, or house renovations?

How you'll meet the savings target for your wedding?

How will future children affect your cashflow and household income?

If you can actually retire early based on the trajectory you're on now?

There is a way.

It's through optimising your lifetime cashflow, and making your money work harder for you, instead of you working hard for your money. That is what Stride can help you achieve.

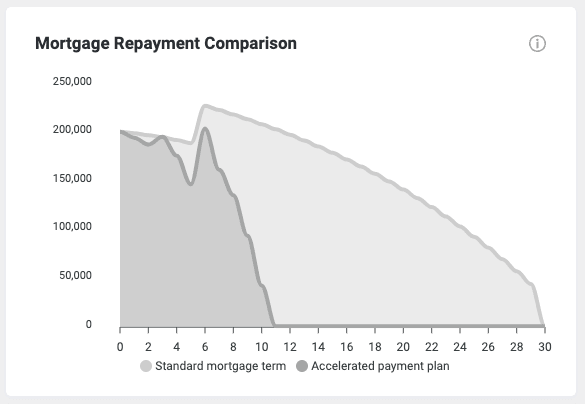

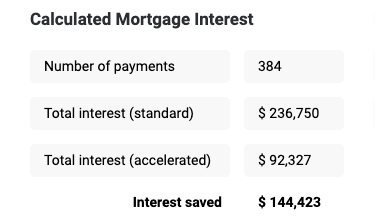

For example, what does your mortgage repayment graph looks like?

How much could you save on interest, through an accelerated mortgage repayment plan?

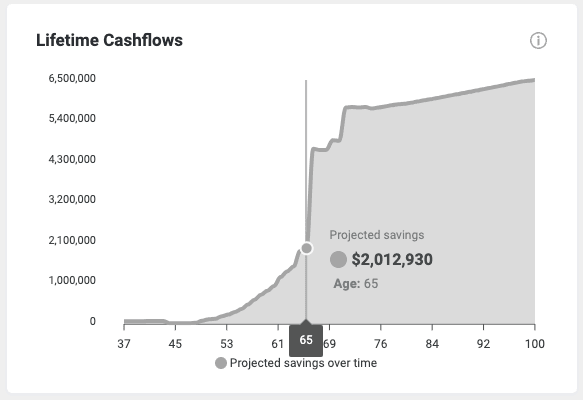

OR what does your lifestyle and choices look like at the age of 65?

Will you be in a position to retire early, as you intended to? Not many want to work up-to and beyond 65 years of age.

" Building financial confidence, one strategy at a time. One action at a time. "

We do this by taking you and/or your partner through the following journey:

Discovery & Data Gathering

We get to know you and gather information about you, your family, household finances, and goals, to complete a full picture of how you are placed currently.The Real Fun - Strategy Workshop

We take you through a strategy workshop where we look at where you are now. With the help of graphs, we show you in real time, how your financial decisions and life events impact your lifestyle and choice in 20, 30 years.What you walk away with

In the end, you'll walk away with a strategy report that aligns with your capacity to meet your financial goals, along with a 90 day - 180 day actionable plan.Best part?

The Action Plan is adaptable and evolves as you build financial strength or as your circumstances change.

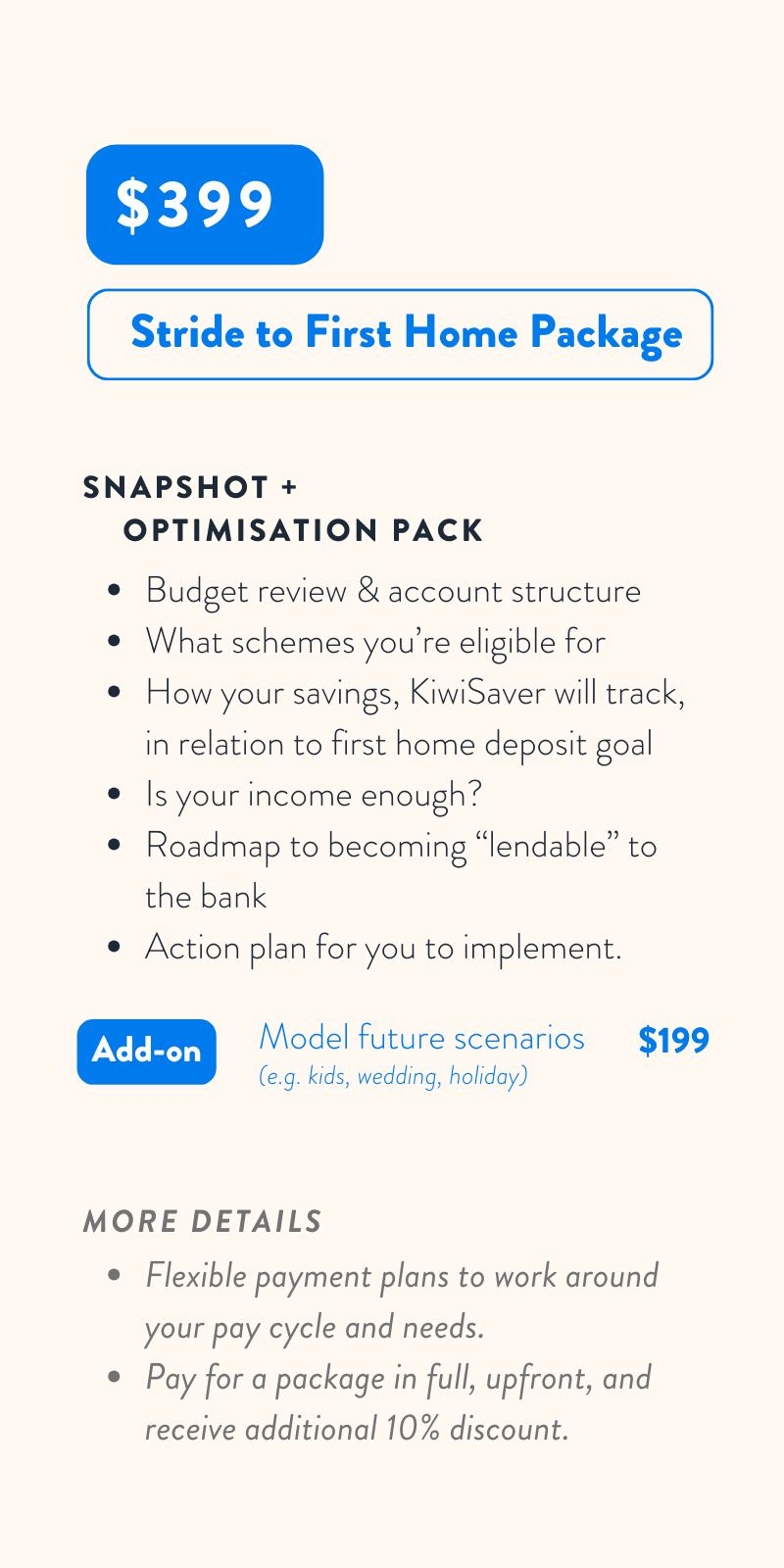

We have two packages for you to choose from, depending on your goals.

Let's take a deeper dive into the full value you'll get out of our Strive Package.

Where you are now VS First Home

Your current financial position

How much of home loan can you expect from bank / lender, based on your household income?

Deposit goals

What is your deposit goal? How much of this can be attributed to KiwiSaver and how much needs to be attributed to personal savings and/or other options?

How is your KiwiSaver tracking? How can you optimise your KiwiSaver performance and contributions?

Why should you be given a massive loan by the bank?

Are you "lendable"? - meaning, why should a bank or lender lend you hundreds and thousands of dollars?

How well will you be able to service your first home loan?

What are ways to optimise your current budget and cashflow?

Based on your budget, how long will you need to continue contributing to personal savings and KiwiSaver, until you meet your deposit goals?

Roadblocks - also known as Financial Risks

What type of roadblocks can get in the way of you achieving your first home goals

What are the next steps on your first home buyer journey, once you meet your deposit goals?

What you walk away with

A 90 to 180 days actionable plan

A report with all our findings on budget review, financial risks / insurance review, KiwiSaver review, tips on cashflow optimisation and debt reduction.

Let's take a deeper dive into the full value you'll get out of our Thrive Package.

Where you are now VS your goals

Snapshot of how you are placed and where you're headed, based on the current trajectory you're currently on.

Projections of your lifetime cashflow and mortgage repayment, based on the current trajectory you're on.

How does this trajectory compare to your short and long term goals?

Review of budget and mortgage structure

Review of current budget

Review of mortgage structure and mortgage repayment strategy.

Basic bank account structure.

Optimised debt reduction and mortgage repayment strategy

How can you pay down mortgage faster and save on interest repayments?

What are some strategies available that can be utilised to pay down mortgage faster?

How to take advantage of any surplus funds and future increases in income to get ahead?

How far away is your next property and other goals?

How far away is your next investment property? What is your deposit goal?

How "lendable" are you? - in the eyes of bank / lender, why should they lend you hundreds and thousands of dollars as a home loan to you?

Can you service the new home loan on the investment property?

How will other financial goals fit in, such as future renovations, family holidays, retiring early, etc?

A closer look at your retirement

How are your retirement goals tracking? What compromises your retirement funding?

Is KiwiSaver part of your retirement goals? If so, how is this tracking?

What are ways we can optimise KiwiSaver performance and contributions?

Roadblocks, contingency plans & insurance review

What are roadblocks that can get in the way of you achieving your financial goals?

What contingency plans have you got in place currently?

Review of your insurance covers in place

What you get to walk away from Thrive Package:

A 90 - 180 days actionable plan, along with written record of the strategy and optimisation we discuss.

A report with our findings on budget review, financial risks / insurance review, KiwiSaver review, strategy on cashflow optimisation, debt reduction, roadmap to next property & other financial goals, and future scenarios reports from our specialised tool.